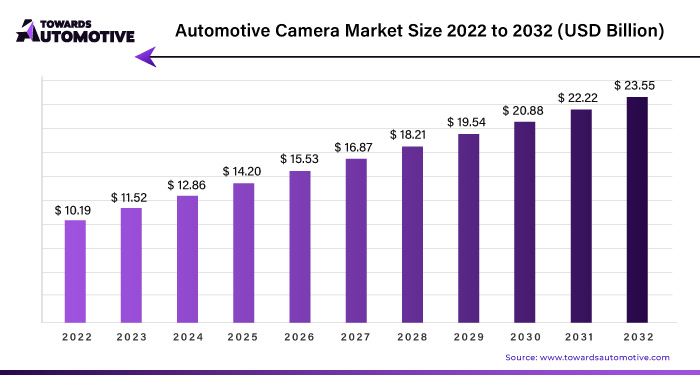

Automotive Camera Market Size to Worth USD 23.55 Bn by 2032

The global automotive camera market size is calculated at USD 12.86 billion in 2024 and is expected to be worth around USD 23.55 billion by 2032, growing at a double digit CAGR of 11.49% from 2024 to 2032.

/EIN News/ -- Ottawa, April 30, 2024 (GLOBE NEWSWIRE) -- The global automotive camera market size surpassed USD 11.52 billion in 2023 and is anticipated to hit around USD 22.22 billion by 2031, according to a study published by Towards Automotive a sister firm of Precedence Research.

The automotive industry has witnessed a surge in the adoption of advanced security devices like car cameras, which offer a comprehensive view of the surrounding environment, thereby enhancing vehicle safety. This growing demand can be attributed to the increasing popularity of advanced driver assistance systems (ADAS) across both developed and developing nations. Car cameras find applications in various functions such as parking assistance, traffic alert systems, and pedestrian detection, among others, contributing to their widespread adoption.

The passenger vehicle segment dominates the global car camera market and is anticipated to maintain its leading position throughout the forecast period. This segment's prominence can be attributed to the crucial role car cameras play in enhancing driver and vehicle safety. By providing drivers with real-time visual information, car cameras empower them to make informed decisions, thereby reducing the risk of accidents and ensuring safer journeys for passengers.

Download a short version of this report @ https://www.towardsautomotive.com/insight-sample/1023

Car cameras are deployed both internally and externally within vehicles, depending on the intended application. Internal dash cams are commonly used for monitoring driver behavior and enhancing overall safety, while external cameras are integral components of vehicle ADAS systems, contributing to their effectiveness in collision avoidance and other safety features.

Luxury car manufacturers are expected to drive significant revenue growth in the car camera industry, as they increasingly integrate advanced safety features into their vehicles to appeal to discerning consumers. Furthermore, continuous innovation in product development, the introduction of cutting-edge technologies, and the provision of comprehensive after-sales services are poised to fuel market expansion, ensuring sustained growth and technological advancement in the automotive camera sector.

The automotive industry is experiencing a significant surge in the demand for enhanced safety and convenience features, driving rapid advancements in vehicle technology. With a growing emphasis on safer driving experiences, the industry has witnessed the widespread adoption of advanced safety features designed to mitigate the risk of accidents and improve overall road safety. In response to consumer demand, modern vehicles are equipped with a range of safety functionalities such as blind spot detection, forward collision warning, lane departure warning, and electronic stability control, among others.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

In recent years, there has been a notable evolution in safety features, with the integration of advanced driver assistance systems (ADAS) becoming increasingly prevalent. These systems offer a comprehensive suite of safety functionalities, including lane assist, self-parking capabilities, video playback, emergency braking systems, and advanced traffic management navigation tools. The introduction of these advanced features has revolutionized the driving experience, providing drivers with greater confidence and peace of mind on the road.

As consumer preferences continue to evolve, automakers are committed to delivering vehicles equipped with cutting-edge safety functionalities, further enhancing the safety and convenience of driving for motorists worldwide.

The automotive industry has witnessed a significant shift towards the integration of advanced safety features, with many functionalities now offered as standard or optional upgrades in vehicles. In response to evolving safety regulations and consumer preferences, original equipment manufacturers (OEMs) such as Toyota and Honda have embraced this trend by equipping their vehicles with a comprehensive suite of safety technologies.

Standard features like blind-spot monitoring, reverse traffic alert, lane keep assist, forward collision warning, and emergency automatic braking have become commonplace in modern vehicles, enhancing driver awareness and mitigating the risk of accidents. These safety systems often rely on multiple cameras strategically positioned around the vehicle to provide various perspectives, including front, rear, and surround views.

The adoption of advanced driver assistance systems (ADAS) has further propelled safety innovation in the automotive industry, with automakers like Cadillac, Tesla, Nissan, and Audi leading the way in developing Level 3 autonomous driving capabilities for future models. These advancements in autonomous technology promise to revolutionize the driving experience, offering enhanced safety and convenience for motorists.

Increasing demand for features such as cruise control and driving comfort underscores the growing importance of safety in the automotive market. As consumer expectations continue to evolve, OEMs are focused on delivering vehicles equipped with cutting-edge safety functionalities to meet the needs of modern drivers.

Smart cameras represent a significant advancement in automotive safety technology, designed to meet the stringent requirements of programs like NCAP (New Car Assessment Program) and offering distinct advantages over other sensor technologies such as radar, lidar, or ultrasound. By leveraging sophisticated image processing algorithms, these cameras can intelligently monitor road signs, traffic signals, and other visual cues, enabling them to identify objects and provide critical information to enhance vehicle safety.

One of the key advantages of smart cameras is their ability to recognize and track vehicles, pedestrians, and other objects in real-time, allowing them to detect movements and calculate distances accurately. This capability not only improves visibility for drivers but also enables advanced safety features such as automatic emergency braking, which can help prevent collisions by alerting the driver or autonomously applying the brakes when necessary.

Moreover, smart cameras offer a more comprehensive and holistic approach to environmental perception, complementing other sensor technologies to provide a robust perception system for autonomous driving applications. By combining visual information with data from radar, lidar, and other sensors, smart cameras can enhance situational awareness and facilitate more precise decision-making for vehicle control and management.

Smart cameras represent a safer and more effective option for automotive safety applications, offering improved visibility, advanced object recognition capabilities, and seamless integration with existing vehicle systems to enhance overall safety and driving experience.

The widespread adoption of Advanced Driver Assistance Systems (ADAS) technology faces challenges in many developing countries due to inadequate connectivity, infrastructure, and internet services such as 5G. Without robust connectivity, vehicles are unable to access cloud-based data and services critical for ADAS functionality, including Vehicle-to-Vehicle (V2V) and Vehicle-to-Everything (V2X) communication. This limitation prevents drivers from accessing advanced safety features and real-time traffic information, compromising the effectiveness of ADAS systems in improving road safety.

As a result, Original Equipment Manufacturers (OEMs) may limit the availability of ADAS products to select models or premium packages that offer better connectivity solutions. This approach ensures that ADAS features are only deployed in environments where reliable connectivity is available, thereby optimizing their performance and effectiveness.

Addressing the connectivity challenge is crucial for the widespread adoption of ADAS technology, as it not only enhances the safety and convenience of driving but also lays the foundation for future advancements in autonomous driving and smart transportation systems. Efforts to improve connectivity infrastructure and expand internet access in developing countries will play a key role in unlocking the full potential of ADAS technology and improving road safety worldwide.

The global car camera market is experiencing significant growth driven by the increasing adoption of Advanced Driver Assistance Systems (ADAS) features in passenger vehicles. Features such as blind spot detection, 360-degree surround view, night vision, and parking surround sound are becoming more prevalent as car buyers prioritize safety in their transportation choices. Major manufacturers are responding to this demand by introducing new cameras equipped with advanced functionalities and enhanced levels of camera resolution to meet stricter safety standards.

One critical aspect of the dashcam industry is its contribution to improving overall vehicle safety by monitoring driver behavior. This function plays a vital role in enhancing vehicle safety by providing real-time monitoring of driver actions and behaviors.

The rising adoption of Level 4 (highly automated) and Level 5 (fully automated) driving technologies is further fueling the demand for in-car cameras. Leading players in the market are strategically capitalizing on these opportunities by introducing innovative products such as focusable cameras, camera-based depth sensing platforms tailored for fully autonomous and semi-autonomous vehicles, and integrating artificial intelligence and machine learning-based models for enhanced functionality and service integration.

Automotive camera market is witnessing rapid expansion as manufacturers leverage technological advancements to meet the evolving safety and convenience needs of consumers, driving the integration of sophisticated camera systems into modern vehicles.

Rise in Adoption of 360-degree View Cameras to Drive Global Automotive Camera Market Growth

The automotive industry is witnessing a significant trend with the widespread adoption of 360-degree camera installations across various vehicle segments. What was once a feature exclusive to luxury or premium vehicles has now become increasingly common among Original Equipment Manufacturers (OEMs) across the board. These installations typically comprise at least four cameras strategically placed on the front and rear of the vehicle, providing drivers with a comprehensive view of their surroundings and enhancing overall vehicle safety by facilitating better decision-making.

In high-end vehicles, multiple cameras are employed to offer a more detailed interpretation of the surrounding environment, providing drivers with a clear 360-degree view. Leading automakers like Maruti Suzuki and Hyundai have incorporated this feature into their premium hatchbacks and other models, making it accessible to a broader range of consumers. The integration of a 360-degree camera into the rearview mirror enables drivers to view images from all sides, enhancing their visibility and maneuverability, particularly during turns.

As the popularity of 360-degree view cameras continues to rise, driven by their proven benefits in enhancing situational awareness and improving safety, their widespread adoption is poised to positively impact the growth trajectory of the global car camera market in the foreseeable future.

Stringent Automotive Safety Regulations and Surge in Incorporation of ADAS Systems in Vehicles to Boost Automotive Camera Market Demand

The automotive camera market is poised for significant growth, driven by new vehicle safety regulations and advancements in imaging capabilities. Regulations such as the North American Federal Safety Regulations for Autonomous Vehicles and the Euro NCAP's Assessment Protocol are expected to boost demand for automotive cameras as automakers strive to comply with safety standards. Additionally, the development of 360-degree and high-resolution imaging technologies, coupled with backend data analysis services, is further fueling market demand.

The increasing adoption of Advanced Driver Assistance Systems (ADAS) and the progression towards higher levels of vehicle autonomy, particularly in major markets like China, are significant factors contributing to the expansion of the automotive camera industry. However, the slow development of IT infrastructure in emerging markets such as China, India, Mexico, and Brazil poses challenges to market growth.

While dash cameras play a crucial role in enhancing road safety by capturing critical footage, their inability to communicate with other vehicles or infrastructure limits their effectiveness in certain scenarios. Conversely, AI-based cameras designed for autonomous driving excel in identifying objects and signs, facilitating features like emergency braking. Nonetheless, the integration of communication capabilities into dash cameras is still in its nascent stages and holds promise for enhancing overall road safety.

Despite the potential of automotive cameras to improve safety and efficiency on the roads, the sluggish pace of traffic development in many emerging markets may hinder the growth of the dashcam market in the foreseeable future. Continued efforts by regional organizations and automakers to develop and integrate advanced technologies will be essential in overcoming these challenges and driving the adoption of automotive cameras worldwide.

North America is Expected to Experience a Fastest Growth

North America is poised to take the lead in the vehicle-mounted camera market, driven by robust demand for larger vehicles across the United States, Canada, and Mexico. The widespread adoption of advanced driver assistance systems (ADAS) in both commercial and residential settings further contributes to market growth. Moreover, the integration of cameras as a desirable feature in luxury vehicles, coupled with increased corporate involvement, serves as a key driver for expanding the vehicle-mounted camera industry in the region.

Furthermore, the rising consumer preference for security systems is fueling market expansion, leading to heightened demand for cameras in North America. For instance, in August 2019, Magna inaugurated a new $50 million manufacturing facility near Flint, Michigan, to cater to the growing customer demand for digital cameras in the region.

Meanwhile, Europe is anticipated to maintain a substantial market share in the vehicle-mounted camera segment, primarily due to stringent requirements for ADAS and passenger safety systems in countries like Germany, the UK, France, and Italy. Initiatives such as the New Car Assessment Program (NCAP) also play a pivotal role in driving the development of the global driving recorder market in Europe.

China and South Korea are poised to exhibit promising growth in automobile production, further contributing to the expansion of the vehicle-mounted camera market. As these regions continue to invest in automotive technology and safety initiatives, the demand for cameras in vehicles is expected to witness significant growth.

Browse More Insights of Towards Automotive:

- The automotive fasteners market size was at USD 59.79 billion in 2023, and is predicted to reach USD 84.66 billion by 2032, growing at a CAGR of 4.44% during the forecast period.

- The automotive on-board charger market size to rise from USD 4.85 billion in 2023 to reach USD 87.11 billion by 2029, growing at a CAGR of 43.48% during the forecast period.

- The electric boat and ship market size to surge from USD 6.8 billion in 2023, and is anticipated to hit USD 16.49 billion by 2032, growing at a CAGR of 12.47% during the forecast period.

- The electric vehicle motor communication controller market size was at USD 726.96 million in 2023 to reach USD 2298.90 million by 2032 at a CAGR of 15.48%.

- The pantograph bus charger market size to rise from USD 3.72 billion in 2023 to hit an estimated USD 12.14 billion by 2032, growing at a CAGR of 15.95% during the forecast period.

- The passenger car accessories market size was at USD 203.04 billion in 2023 and is expected to reach USD 455.40 billion by the year 2032, growing at a CAGR of over 11.21%.

- The rally sport riding gear market size to surge from USD 3.56 billion in 2022 and predicted to reach USD 7.80 billion by the year 2032, registering a CAGR of 9.11% during the forecast period.

- The mining equipment market size is valued at around USD 96.5 billion in the year 2022, and it is expected to reach USD 169.30 billion in the year 2032, registering a CAGR of about 6.45% during the forecast period.

- The automotive turbocharger market size was valued at over USD 13.16 billion in 2022 and is expected to reach over USD 27.32 billion by 2032, increasing at a CAGR of around 8.46% during the forecast period.

- The automotive coolant market size to rise from USD 4.24 billion in 2022, and it is expected to reach USD 11.54 billion in the year 2032, registering a CAGR of above 11.77% during the forecast period.

Automotive Camera Market Key Players

- Gentex Corporation

- Continental AG

- Autoliv Inc.

- Hella KGaA Hueck & Co.

- Bosch Mobility Solutions

- Valeo SA

- Magna International Inc.

- ZF Friedrichshafen AG

- Panasonic corporation

- Garmin Ltd.

Automotive Camera Market Segmentation

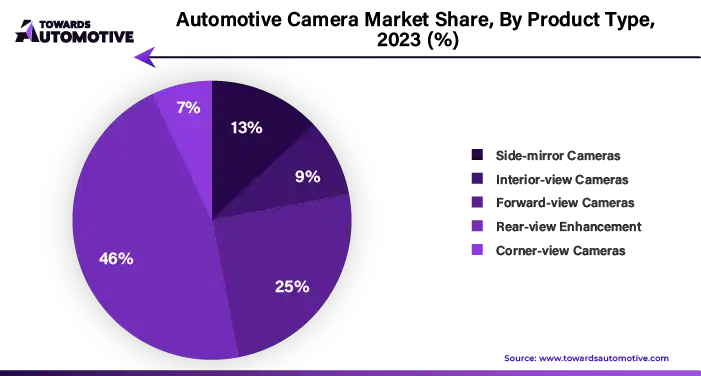

By Product Type

- Side-mirror Cameras

- Interior-view Cameras

- Forward-view Cameras

- Rear-view Enhancement

- Corner-view Cameras

By Vehicle Type

- Compact Passenger Cars

- Mid-sized Passenger Cars

- Premium Passenger Cars

- Luxury Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Application

- Blind Spot

- Drive Recorders

- 360 Surround View

- Lane Departure Warning System (LDWS)

- Night Vision

- Parking Surround View

- Drowsiness

- Distance

- Adaptive Frontlight System (AFS)

- Others

By Technology

- Mono Cameras

- Stereo Cameras

- Infrared Cameras

- Other Cameras

By Level of Automation

- Level 1: Driver Assistance

- Level 2: Partial Automation

- Level 3: Conditional Automation

- Level 4: High Automation

- Level 5: Full Automation

By Sales Channel

- OEM

- Aftermarket

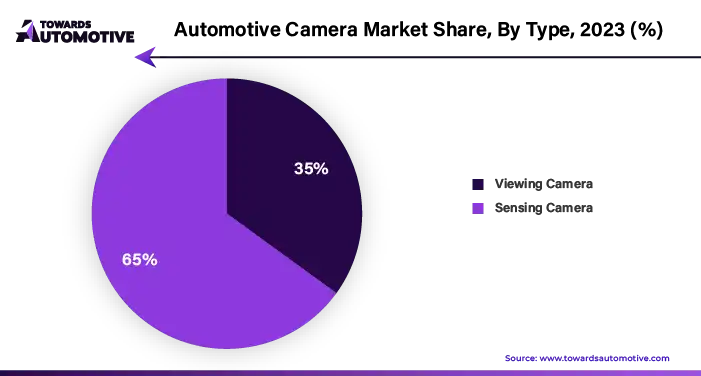

By Type

- Viewing Camera

- Sensing Camera

By Geography

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle-East and Africa

- South Africa

- Rest of Middle-East and Africa

Automotive Camera Market Recent Developments

- In March 2023, NVIDIA announced a partnership with Mercedes-Benz to develop and deploy a new software-defined computing architecture for automated driving. This collaboration aims to enable Mercedes-Benz vehicles to achieve up to Level 4 autonomy using NVIDIA's DRIVE AGX Orin platform.

- Mobileye, an Intel company, unveiled its next-generation EyeQ Ultra system-on-chip (SoC) in April 2023. The EyeQ Ultra features enhanced processing power and advanced AI capabilities, enabling Level 4 autonomous driving functionalities in vehicles.

- Waymo, a subsidiary of Alphabet Inc., launched its fully autonomous ride-hailing service, Waymo One, in select cities in April 2023. Waymo One allows users to hail self-driving vehicles for transportation, marking a significant milestone in the commercialization of autonomous driving technology.

- General Motors (GM) announced in May 2023 that it would be collaborating with Qualcomm Technologies to develop and deploy next-generation vehicle connectivity solutions. This partnership aims to enhance the integration of advanced driver assistance systems (ADAS) and facilitate the transition to autonomous driving.

- Tesla unveiled its new Full Self-Driving (FSD) Beta 10 software update in July 2023. The update includes advanced autonomous driving features such as Navigate on Autopilot, Smart Summon, and Traffic Light and Stop Sign Control, bringing Tesla vehicles closer to achieving Level 5 autonomy.

- Volvo Cars and Luminar Technologies announced a strategic partnership in August 2023 to collaborate on developing and commercializing advanced LiDAR technology for autonomous vehicles. The partnership aims to enhance Volvo's autonomous driving capabilities and accelerate the deployment of safe and reliable self-driving cars.

- Ford Motor Company revealed plans in September 2023 to invest $7 billion in Argo AI, its autonomous vehicle subsidiary. The investment will support the development and commercialization of self-driving technology, with the goal of deploying autonomous vehicles for ride-hailing and delivery services.

- Daimler AG and Bosch announced a joint venture in October 2023 to develop and commercialize automated valet parking services. The partnership will leverage Bosch's expertise in sensor technology and Daimler's automotive engineering capabilities to bring Level 4 automated valet parking solutions to market.

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1023

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Explore the comprehensive statistics and insights on automotive industry data and its associated segmentation: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Web: https://www.precedenceresearch.com

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.