Credit Repair Automate Launches to Simplify Credit Disputes Across Major Bureaus

/EIN News/ -- San Diego, CA, May 02, 2025 (GLOBE NEWSWIRE) -- Credit Repair Automate has just launched online to streamline the credit dispute process with a free, do-it-yourself solution powered by automation technology. Designed to help consumers challenge inaccurate or outdated items in their credit report, this new platform aims to deliver an accessible, user-driven alternative to traditional credit repair services.

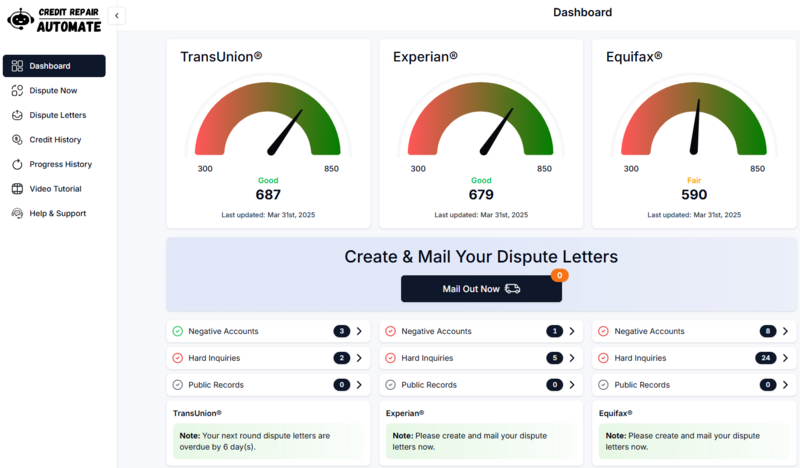

Credit Repair Automate Platform

Credit Repair Automate was built by a team of experienced software engineers and developers after more than a decade of research and development. It addresses long-standing barriers in the credit repair industry by delivering a solution that puts users firmly in charge of their own financial health. The platform enables users to generate, track, and manage dispute letters through an intuitive, step-by-step system, without the high fees often associated with third-party credit repair companies.

“The credit dispute process can be confusing and time-consuming, especially for those unfamiliar with the legal and procedural steps involved,” said Eddie Lemma, a representative of Credit Repair Automate. “Our goal was to create a tool that not only simplifies the process but makes it free and accessible to everyone.”

Offering a Solution to Credit Inaccuracies

Credit inaccuracies are a significant financial issue, affecting millions of Americans. According to the Federal Trade Commission, as many as 42 million Americans, approximately 13% of the population, have errors in their credit reports. One in five consumers has at least one documented error. For about one in ten, that error is significant enough to negatively affect their credit score.

Despite this, correcting credit report errors remains a challenging task. Credit Repair Automate helps consumers address these challenges more easily with a technology-driven solution designed for independent credit management. The system has been developed to comply with established guidelines under the Fair Credit Reporting (FCRA), which grants all US consumers the right to dispute errors in their credit files.

“Most people assume their credit report is accurate until they face a financial hurdle,” added Lemma. “But we now know these mistakes are far more common than expected, and correcting them shouldn’t require hiring an expensive service or navigating a complex system alone.”

Key features of the platform include:

- Unlimited Disputes: Users can file as many disputes as needed across Equifax, Experian, and TransUnion with no limits and no fees.

- AI-Powered Dispute Letter Generation: The system automatically crafts personalized dispute letters based on user input and credit report data.

- Secure Credit Report Access: Integration with a third-party provider ensures safe, encrypted access to users’ credit reports without storing sensitive information.

- Step-by-Step Guided Process: The platform walks users through each stage of identifying inaccuracies and generating appropriate responses.

- Full DIY Control: Users maintain complete oversight of their information and actions, empowering them to manage disputes privately and independently.

- No Cost, No Hidden Fees: Credit Repair Automate is offered at no cost, making reliable credit management tools accessible to everyone.

Helping Dispute a Wide Range of Credit Issues

Credit Repair Automate helps users dispute a variety of negative items in their credit reports, including collections, charge-offs, late payments, medical bills, bankruptcies, and foreclosures. Using AI-driven logic, the platform analyzes credit reports, identifies potential dispute opportunities, and generates customized letters tailored to each issue. This comprehensive support allows users to tackle multiple types of errors systematically, helping them repair and improve their credit profiles.

Improving Accessibility to Credit Repair

As automation and AI continue to transform industries, Credit Repair Automate applies these technologies to a space often left behind in digital innovation. Just as AI-powered budgeting apps and robo-advisors have made investment management more accessible, Credit Repair Automate is bringing the same level of transparency and empowerment to credit health management.

The platform contributes to a broader mission: making financial tools more accessible and equitable.

“Financial empowerment starts with having access to the right tools,” said Lemma. “Credit Repair Automate was created to give consumers a real alternative to expensive credit repair agencies and to make financial self-advocacy achievable for anyone, regardless of background or income.”

The platform is now available online. For more information or to begin the credit dispute process, please visit https://www.creditrepairautomate.com/.

About Credit Repair Automate

Credit Repair Automate is an AI-powered platform created to simplify the credit dispute process and give consumers direct control over managing inaccuracies on their credit reports. Built by a team of technology and financial experts, the platform provides secure access to credit reports, automated dispute letter generation, and unlimited disputes across all three major credit bureaus.

Media Contact

Company Name: Credit Repair Automate

Contact Person: Eddie Lemma

Contact Number: (619) 599-8249

Email: contact@creditrepairautomate.com

Country: United States

Website: https://www.creditrepairautomate.com/

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release